you position:Home > together stock >

Invest Now Stocks: Your Ultimate Guide to Strategic Stock Investment

date:2026-01-23 20:05author:myandytimeviewers(80)

- Financial Health: Look for companies with strong financial statements, including a healthy balance sheet, positive cash flow, and a good return on equity (ROE).

- Market Trends: Stay updated with market trends and economic indicators to identify industries and sectors that are poised for growth.

- Management: Evaluate the quality of the company's management team, as their decisions can significantly impact the company's performance.

- Dividends: Consider companies that offer dividends, as they provide a steady stream of income and can enhance your overall returns.

- Valuation: Assess the stock's valuation using metrics like price-to-earnings (P/E) ratio and price-to-book (P/B) ratio to ensure you're not overpaying for the stock.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio by investing in different sectors and asset classes to mitigate risk.

- Long-Term Perspective: Focus on long-term growth rather than short-term gains. Patience and discipline are key to successful stock investment.

- Regular Monitoring: Keep a close eye on your investments and make adjustments as needed based on market conditions and your financial goals.

- Continuous Learning: Stay informed about the latest market trends, investment strategies, and financial news to make informed decisions.

In the ever-evolving world of finance, investing in stocks can be a game-changer for your financial future. Whether you're a seasoned investor or just starting out, the idea of "invest now stocks" is a powerful one. This article will delve into the key aspects of stock investment, offering you a comprehensive guide to make informed decisions and maximize your returns.

Understanding the Basics of Stock Investment

To begin with, it's crucial to understand what stocks are and how they work. A stock represents a share in the ownership of a company. When you buy stocks, you're essentially purchasing a piece of that company, which entitles you to a portion of its profits and voting rights, depending on the type of stock.

The Importance of Research

One of the most critical aspects of successful stock investment is thorough research. This involves analyzing various factors, such as the company's financial health, market trends, and industry outlook. By doing so, you can identify promising stocks that have the potential to grow in value over time.

Key Factors to Consider When Investing in Stocks

Strategies for Successful Stock Investment

Case Study: Apple Inc.

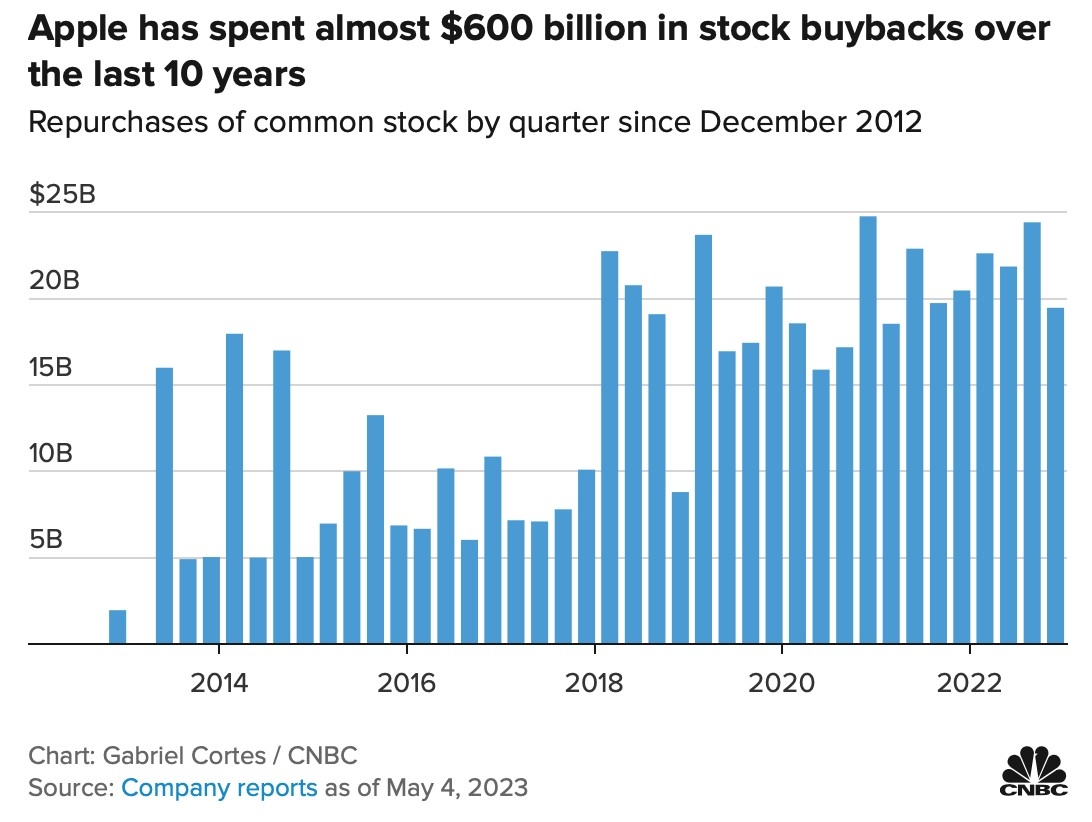

A prime example of successful stock investment is Apple Inc. (AAPL). Since its initial public offering (IPO) in 1980, Apple has grown to become one of the world's most valuable companies. By consistently investing in innovative products, strong management, and a loyal customer base, Apple has delivered exceptional returns to its shareholders.

Conclusion

Investing in stocks can be a powerful tool for building wealth. By understanding the basics, conducting thorough research, and adopting a strategic approach, you can maximize your returns and secure a prosperous financial future. Remember, "invest now stocks" is not just a phrase; it's a commitment to your financial well-being.

together stock

last:New York Life Stock: Understanding the Investment Opportunities"

next:nothing

likes stocks

- New York Life Stock: Understanding the Investment Opportuniti

- Dow 2024 Performance: A Comprehensive Analysis

- At What Time Does US Stock Market Open?

- Unlocking Opportunities: A Comprehensive Guide to CFD Trading

- Master the Art of NASDAQ Investing: A Comprehensive Guide

- Live Dow Jones Stock Market Today: Stay Updated with the Late

- Chile Stock Market vs. US: A Comprehensive Comparison

- Dow Jones Stock Market Graph Today: A Comprehensive Analysis&

- Investment Charts: Your Ultimate Guide to Financial Success

- 6-Month Stock Market Chart: A Deep Dive into Market Trends an