you position:Home > together stock >

Unlocking Success: The Art of Investing Analysis

date:2026-01-23 20:21author:myandytimeviewers(69)

- Stay Informed: Keep up-to-date with financial news, market trends, and economic indicators.

- Develop a Strategy: Establish a clear investment strategy based on your goals, risk tolerance, and time horizon.

- Diversify: Spread your investments across various asset classes to reduce risk.

- Use Tools and Resources: Utilize financial analysis tools and resources to enhance your investing skills.

Investing analysis is the cornerstone of successful investing. It involves a meticulous examination of financial data, market trends, and economic indicators to make informed decisions. In this article, we delve into the essential components of investing analysis and provide practical tips for investors at all levels.

Understanding Financial Statements

The first step in investing analysis is to understand the financial statements of a company. These include the balance sheet, income statement, and cash flow statement. The balance sheet provides a snapshot of a company's assets, liabilities, and equity. The income statement shows the company's revenues, expenses, and net income. The cash flow statement reveals the inflow and outflow of cash within a company.

Analyzing Financial Ratios

Financial ratios are tools used to assess a company's financial health and performance. Common ratios include the price-to-earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE). A P/E ratio below the industry average may indicate a company is undervalued, while a high debt-to-equity ratio could suggest excessive risk.

Evaluating Market Trends

Market trends play a crucial role in investing analysis. Investors should stay informed about economic indicators, such as interest rates, inflation, and unemployment rates. Additionally, understanding the broader market trends and sectors can help identify potential opportunities and risks.

Economic Indicators

Economic indicators provide insights into the overall health of an economy. Some key indicators include the Consumer Price Index (CPI), Gross Domestic Product (GDP), and unemployment rate. These indicators can help investors anticipate changes in the market and adjust their investment strategies accordingly.

Technological Analysis

Technological analysis involves examining historical price and volume data to identify patterns and trends. This approach is particularly useful for short-term traders and can help predict market movements.

Fundamental Analysis

Fundamental analysis involves evaluating a company's business model, management team, and competitive advantage. This approach requires a deep understanding of the industry and the company's operations.

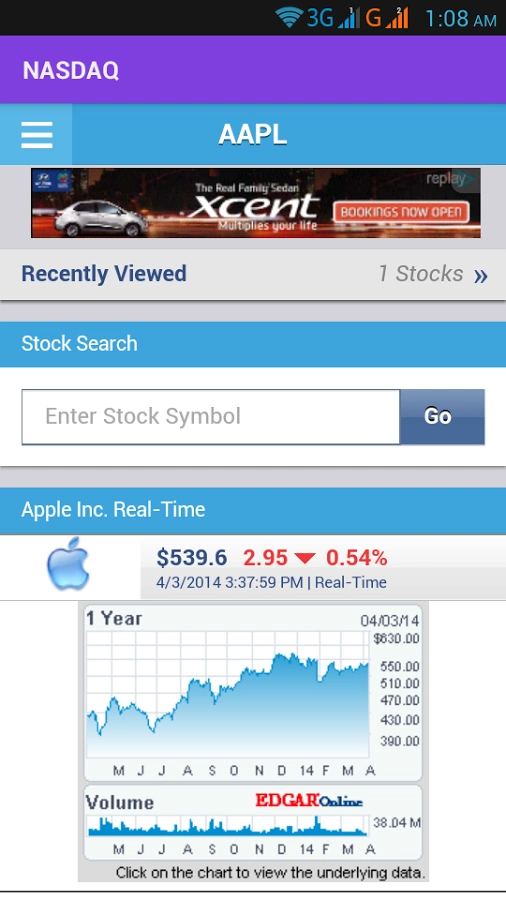

Case Study: Apple Inc.

Let's consider a case study involving Apple Inc. (AAPL). Over the past decade, Apple has demonstrated strong financial performance and has consistently grown its revenue and earnings. By analyzing the company's financial statements, we can see that it has a low P/E ratio compared to its peers, indicating that it may be undervalued. Additionally, Apple's strong brand and innovative products give it a competitive edge in the market.

Practical Tips for Investing Analysis

In conclusion, investing analysis is a critical component of successful investing. By understanding financial statements, analyzing financial ratios, evaluating market trends, and staying informed about economic indicators, investors can make informed decisions and achieve long-term success. Remember, investing is not just about making money; it's about building wealth for the future.

together stock

last:Google After Hours: The Inside Story of What Happens Beyond the Clock

next:nothing

likes stocks

- Google After Hours: The Inside Story of What Happens Beyond t

- Dow Index History: A Comprehensive Timeline of Market Milesto

- Standard Bank Webtrader: Your Ultimate Gateway to the US Stoc

- Stock Analysis: Mastering the Art of Investment Decisions

- Unlocking the Potential of Nasque Stock: A Comprehensive Guid

- Is the US Stock Market Open on Christmas Eve?

- Finance Yahoo Comm: Unveiling the Power of Comprehensive Fina

- Are Share Markets Open Today? Your Ultimate Guide

- Stock Performance Tracker: Your Ultimate Guide to Monitoring

- Lowest Stock Price Right Now: Unveiling the Market's Hid